Investing In A Bear Market: Strategies for Successful Investing

Updated Sept 29, 2023

We will employ a historical backdrop to emphasize this crucial lesson. The rationale is straightforward: those who do not learn from history are destined to repeat it. Moreover, history serves as a mirror, reflecting precisely what we have done and will likely continue to do in the future.

In investing, bear market fears often feel like a well-rehearsed trick designed to stampede the masses. These fears are perpetuated by self-proclaimed experts, often resembling snake-oil salesmen, who delight in crafting all sorts of fables about how the markets are destined to crash. Some more eccentric characters even go so far as to predict the arrival of the mother of all bear markets, one that would supposedly wipe out all the gains from the past two decades. Yet, these individuals have been waiting in vain for their day in the sun, as instead of witnessing a market crash, what has genuinely crashed is their ego. The only downtrend in sight is their dismal forecasting record.

Viewed from the lens of Mass Psychology, bear markets present themselves as unique opportunities for investment. They serve as the breeding grounds for the next bull market. When you encounter these so-called experts loudly proclaiming the imminent collapse of the financial world, it’s advisable to filter out the noise and focus on the facts. What is genuinely collapsing is their egos. Historical data reveals that markets tend to trend upward for much longer periods than they trend downward.

Investing in a Bear Market: Upping the Ante

If you had purchased top-rated companies when the masses were dumping their stock during the so-called crash phase, you would have made a fortune over the years. Sol Palha

Investing in a bear market can be a lucrative strategy if approached with caution and a long-term perspective. When the market experiences a downturn and the masses start selling their stocks, it can create opportunities for astute investors. Timing is crucial, and looking for extreme shifts in market sentiment is essential.

During periods of euphoria when the crowd is overly optimistic, it may be wise to take profits and adopt a more cautious stance. On the other hand, when panic sets in, and there is widespread pessimism, it could be an opportune time to start considering investments in top-rated companies.

Investors can identify potential entry points during a bear market by analysing market indicators and sentiment. It’s essential to conduct thorough research and due diligence on the companies being considered for investment. Evaluating their financial health, competitive advantage, and long-term growth prospects can help determine their resilience in challenging market conditions.

While it’s important to be proactive during a bear market, exercising patience and avoiding making impulsive decisions is equally crucial. Investing in a bear market requires a long-term perspective, as it may take time for the market to recover and for investments to yield significant returns.

In summary, investing in a bear market can present unique opportunities for investors willing to analyze market sentiment and make informed decisions carefully. By focusing on top-rated companies and adopting a long-term perspective, investors can capitalize on the market’s downturn and position themselves for future growth.

Exciting read: Economy: Exploring Different Economic Systems

Market Selloffs: Experts vs. Lunatics

A multitude of articles are hastily crafted as financial experts cling to the hope of a different outcome. This serves as a stark illustration of repeating the same, futile narratives with the unfounded expectation of a sudden change in results. It’s noteworthy that these individuals exhibit a remarkable talent for crafting fiction, prompting one to ponder why they haven’t pursued careers in that field, given their proficiency; reality appears to elude them.

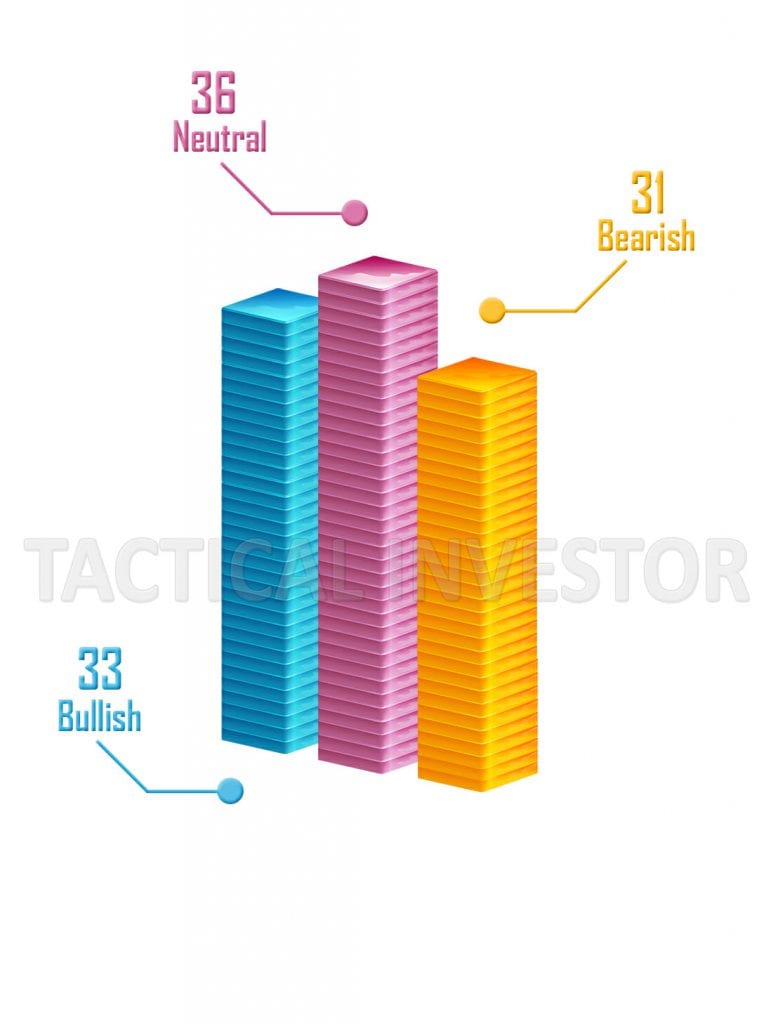

Since the inception of this bull market, we have consistently emphasized that its duration is unlikely to conclude significantly until sentiment becomes overwhelmingly bullish. In January, bullish sentiment surged past 60% for the first time in years. While this development could have signalled the end of the bull market, the markets swiftly released substantial pressure quickly, and negative sentiment has begun to rise. Bullish sentiment has progressively declined since its peak in January 2018. Consequently, at present, the possibility of a crash must be discounted. However, the markets will persist in oscillating within a broad range until they transition into an oversold condition.

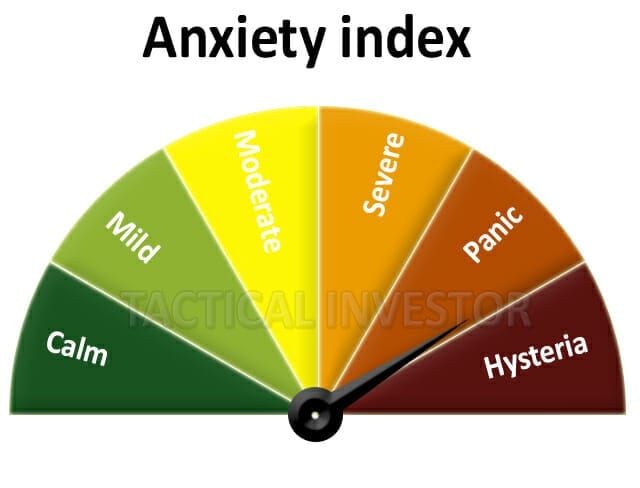

Market sentiment is far from bullish.

The gauges below undeniably illustrate that the majority is far from adopting a bullish stance. One of the fundamental tenets of mass psychology emphasizes refraining from taking positions against the prevailing sentiment of the masses unless sentiment readings reach the extreme zone.

The Technical Picture

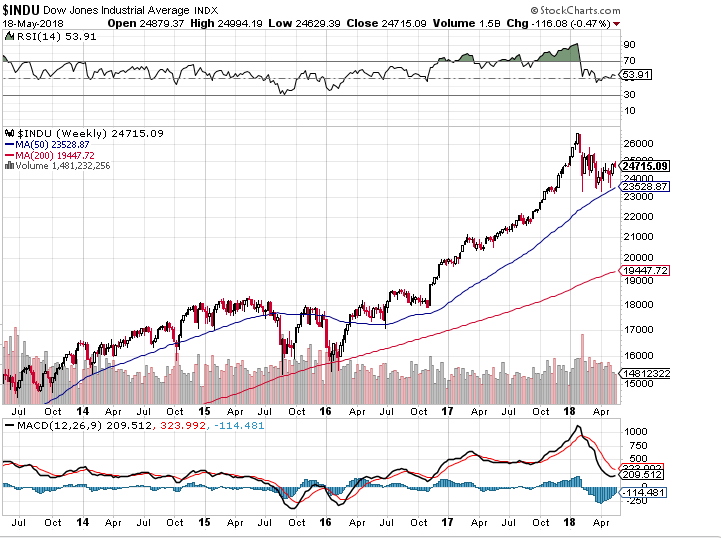

The weekly chart of the Dow

While the markets are currently trading within oversold ranges on the weekly charts, it’s important to note that they are still within highly overbought ranges on the monthly charts. Consequently, we anticipate ongoing volatility in market actions until there is alignment between the weekly and monthly charts. Until such alignment occurs, the Dow will probably continue to trade within a defined range.

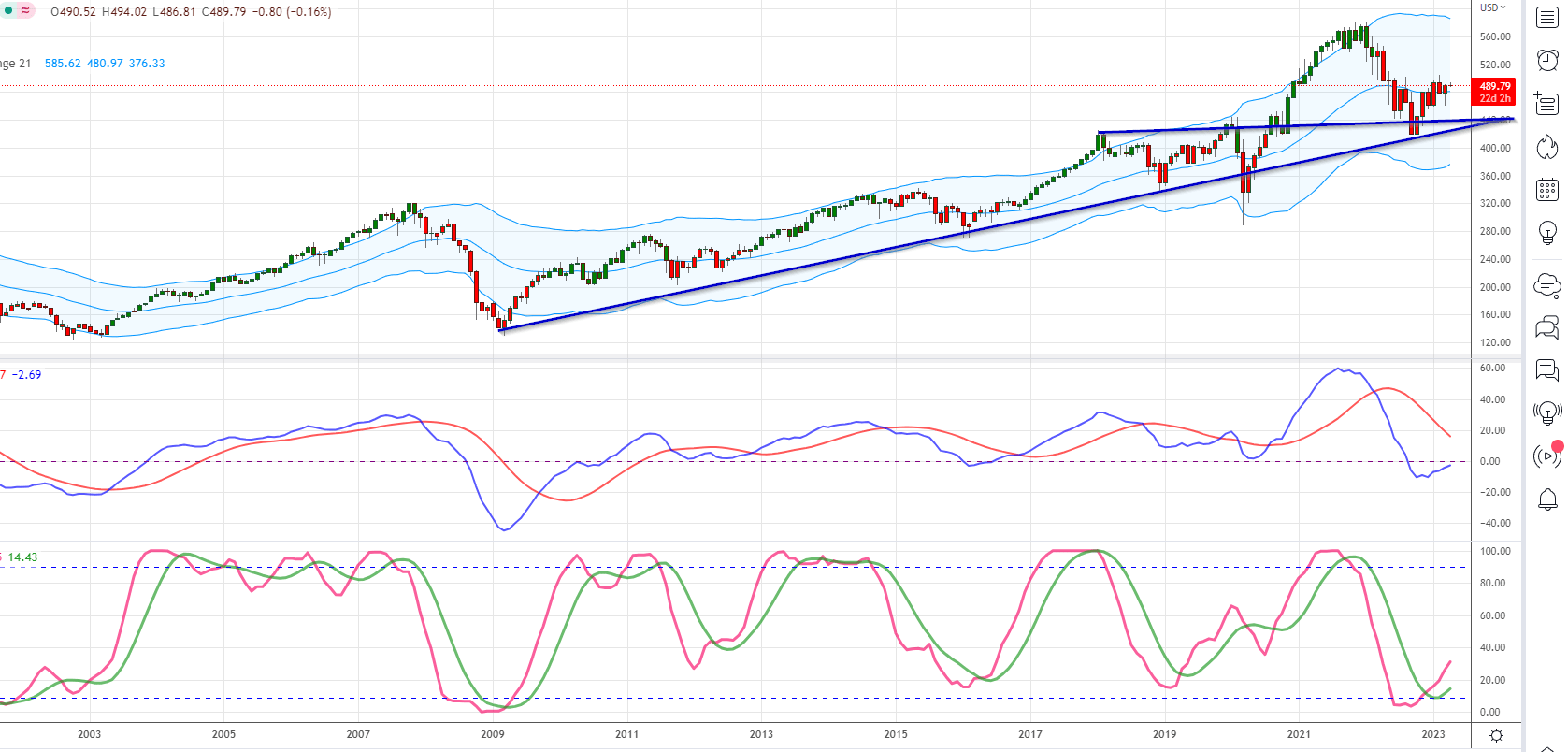

Ultra long term Chart of the Dow

The prevailing trend exhibits no indications of weakening, and therefore, any substantial pullbacks should be interpreted with a bullish perspective. For individuals fixated on the idea of a bear market or an impending crash, it’s essential to recall that markets can remain irrational for extended periods. Betting against such irrationality can often lead to financial challenges, as markets can persist longer in their irrational state than most traders can sustain their positions.

On a conventional basis, Inflation remains a non-event

We use the term “conventional” to refer to the authentic definition of inflation, an increase in the money supply. Since the financial crisis of 2009, the money supply has indeed surged. However, contemporary economists have altered this definition, focusing instead on rising prices, which is merely a symptom of the underlying issue.

Central bankers worldwide, except a few countries, including the United States, are not rushing to embrace higher interest rates. Most central bankers recognize that much of the economic recovery has been driven by the influx of “hot money.” Consequently, they are in no hurry to curtail the flow of funds, as doing so could potentially trigger even more painful consequences.

Nonetheless, a low-interest-rate environment proves advantageous for corporations. They can secure more affordable loans and utilize these funds to engage in share buybacks, almost magically bolster earnings per share (EPS).

Investing in a Bear Market: Rule #1 – Disregard the Naysayers

The pessimists have been predicting a bear market for decades, yet each bear market forecast has met a dismal end. To illustrate, these bearish predictions persisted when the Dow was trading below 20k and continued when it crossed the 21k threshold, and so on. The narrative remains unaltered.

Rather than squandering valuable time heeding these repetitive warnings, examining their track records is prudent. The results are quite astonishing: more than 90% of these pessimists have consistently reiterated the same baseless narrative over the years, and they are still active in the market. What does this reveal? Well, if these “Doctors of Doom” had followed even a fragment of their own advice, they would have bankrupted themselves multiple times over. Their continued presence suggests that they are attempting to peddle their flawed information to you, typically for a fee, information they are unwilling to follow.

Embracing the Novel Approach: Prioritizing Trends Over Noise

Determine the trend and pay close attention to market sentiment; shorting the markets is a recipe for disaster and vice versa if the masses are not euphoric. Fundamentals and technicals are both useless when used in separation. Examine the emotion driving the markets. What are the masses thinking or doing? Stock markets constantly crash on a note of euphoria, and the masses are, for now, far from happy.

An intriguing concept emerges in the ever-evolving world of financial markets: unravelling the enigmatic world of market sentiment and mass psychology. This novel idea takes us on a captivating journey that challenges conventional wisdom and uncovers the hidden forces that shape market trends.

Picture this: You’re at the helm of your investment strategy, and you possess a profound understanding of mass psychology. You’re no longer solely reliant on fundamentals and technicals; instead, you’ve unlocked the key to success by deciphering the emotions steering the markets.

Market sentiment is the compass, and mass psychology is the guiding star. When the masses are not consumed by euphoria, shorting the markets becomes a problematic endeavour. Conversely, when exuberance reigns supreme, a bearish stance can be a recipe for disaster. This dynamic interplay between sentiment and market behaviour is where true mastery lies.

Fundamentals and technical analysis, once considered indispensable, now find their true value in synergy with mass psychology. You gain a strategic advantage when you know what the masses are thinking. You become attuned to the collective pulse of investors, giving you the ability to anticipate market shifts and trends with precision.

Consider this: stock markets have historically crashed on the crescendo of euphoria. For now, it’s a paradoxical twist of fate, and the masses seem far from reaching that euphoric crescendo. As an astute investor, you must discern when that moment arrives and adjust your strategy accordingly.

In this exhilarating journey of mastering mass psychology, you become a market whisperer, interpreting the collective mood of investors and predicting market movements with uncanny accuracy. You stand at the forefront of a revolution in investment strategy, where understanding the emotional currents of the masses is the key to unlocking unprecedented success.

As you delve deeper into this fascinating realm, you’ll find that numbers and charts do not just drive the markets; millions’ hopes, fears, and sentiments profoundly influence them. The next market trend may well be decoded by understanding the collective psychology of the masses, and you, as a pioneering investor, are poised to lead the way into this exciting new frontier of investment strategy.

Capitalizing on Opportunity: How Bear Markets Offer Golden Investment Prospects

In the realm of investment, a fundamental principle emerges: the farther the market deviates from its typical path, the greater the potential for lucrative acquisitions. When adopting a long-term perspective, bear markets should be regarded as an exceptional opportunity to secure shares in outstanding companies at a fraction of their intrinsic worth. Historical data consistently reveals that every bear market paves the way for a bull market that endures 2 to 5 times longer, making the case for seizing these golden investment prospects stronger than ever.

Mastering the Contrarian Mindset: Embracing Market Psychology for Investment Success

In contrarian investing, embracing market psychology is your key to unlocking success. While your grasp of the fundamentals and emotional discipline is commendable, there’s more to explore:

1. Fundamental Analysis and Market Dissonance:

Contrarian investing thrives on identifying market dissonance. Dive into fundamental analysis, dissecting financials, assessing industry positions, and evaluating management quality. Seek opportunities where market sentiment dances out of rhythm with intrinsic values.

2. Risk Management: Shield Against Turbulence:

Embrace the contrarian spirit but acknowledge its inherent risks. Implement risk management techniques like diversification and prudent position sizing. These shields will protect your portfolio from the stormy seas of contrarian waters.

3. The Patience of a Contrarian Sage:

Time is the ally of the contrarian. Market sentiments shift slowly; give your investment thesis the grace of time. Avoid the sirens of impulsive decisions and navigate by the lighthouse of long-term potential.

4. Unearthing Value through Rigorous Inquiry:

Contrarian success lies in the soil of research and due diligence. Investigate the roots of prevailing market sentiment. Seek the seeds of valid fundamental reasons supporting your contrarian view. This soil bears the fruit of informed investment decisions.

5. Flexibility in the Contrarian Landscape:

Contrarian investing is like taming a tempest; flexibility and adaptability are your anchors. Market currents change, requiring course adjustments. Be vigilant and willing to alter your strategy as new information emerges, ensuring your compass stays true.

6. Errors as Stepping Stones:

A contrarian’s journey is not without missteps. Admit, analyze, and ascend. Each error is a stepping stone, honing your contrarian craft. These lessons from the storm will sculpt you into a seasoned contrarian captain.

Contrarian investing is a grand symphony of psychology, analysis, and discipline. While it carries its perils like all ventures, the reward of mastering it is the siren’s call to any investor. Seek counsel from those who’ve charted these waters successfully, and embrace the contrarian mindset. In the grand theatre of investing, where sentiment plays its melodies, your understanding of market psychology and the contrarian spirit shall be your standing ovation.

Random Reflections: A Rational Approach to Investment Language

The financial markets are often associated with negative imagery, with terms like “bullish,” “bearish,” and “bug” painting a picture of irrational creatures or distastefulness. However, this perspective misrepresents many traders’ sophisticated and calculated approach.

The market is a complex ecosystem where intelligence, strategy, and rationality play significant roles. It’s not just about being swayed by emotions or irrationality. It’s about making informed decisions based on a thorough understanding of market trends, economic indicators, and financial data.

Therefore, it’s high time we reconsider our language to describe our market positions and views. Instead of using terms that evoke negativity or irrationality, we should strive for a more positive and sophisticated terminology that accurately reflects our level-headed investment approach.

This shift in language can help foster a more positive perception of the markets, encouraging more people to understand and participate in them. It can also help dispel the myth that trading is purely a game of chance, emphasizing instead the importance of knowledge, strategy, and rational decision-making in successful trading.

Originally Published on May 29, 2018, and updated repeatedly over the years, with the latest update being done in September 2023.

Articles of Interest

Examples of Mass Hysteria: Understanding the Power of Collective Fear